The Philippine peso opened the day under familiar pressure.

As of February 10, 2026, the Bangko Sentral ng Pilipinas (BSP) set the reference rate at ₱58.45 per US dollar, a level that once again puts the peso’s global standing into sharp focus. For millions of Filipinos—OFWs, importers, travelers, and everyday consumers—these numbers are more than data. They shape daily life.

Here’s what’s happening at the top of the currency board today.

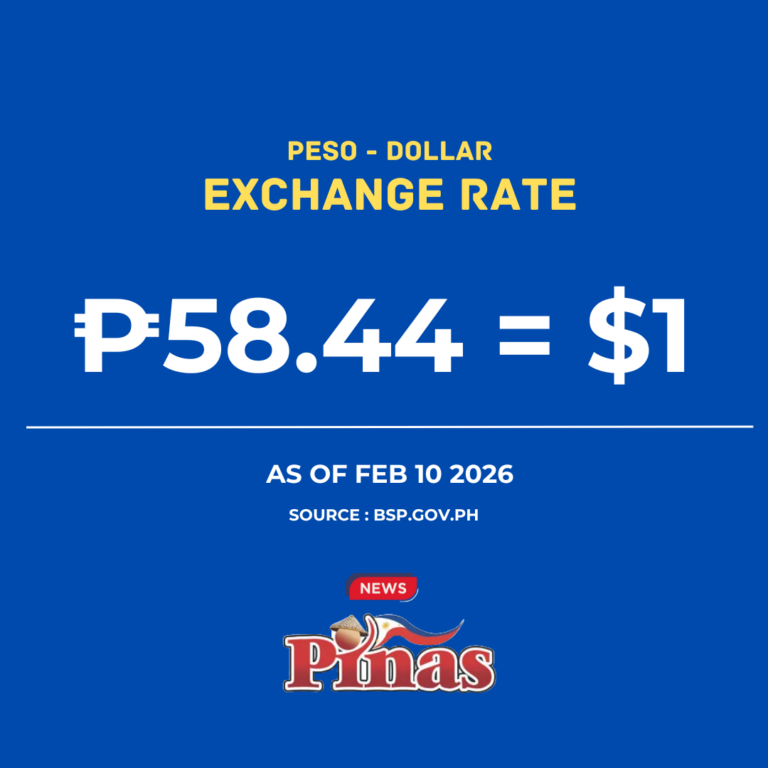

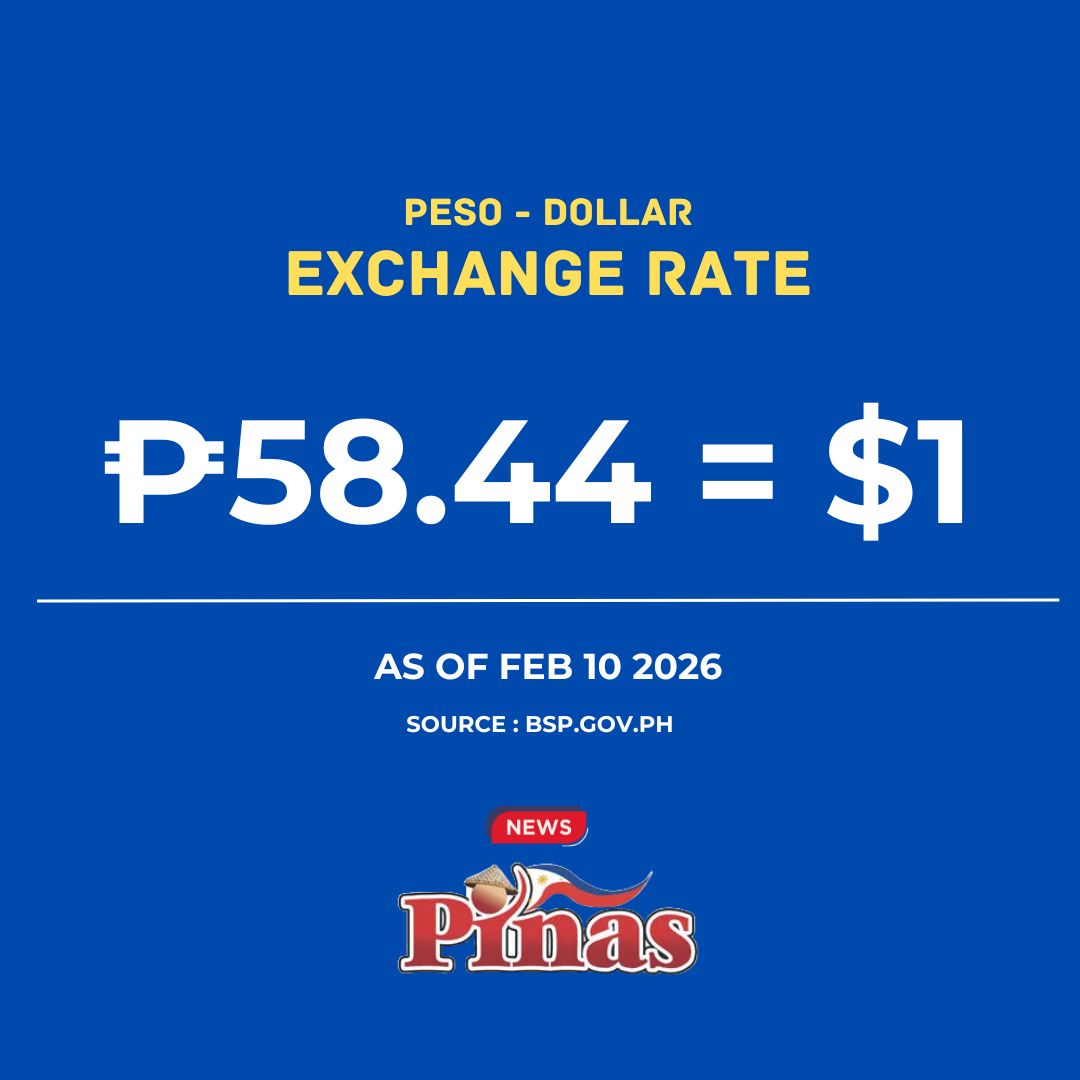

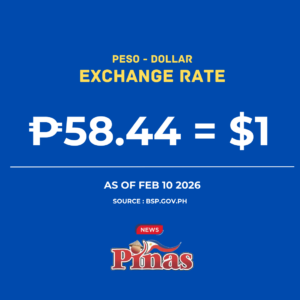

PHP vs US Dollar

The US dollar remains the peso’s biggest benchmark.

At ₱58.44 per $1, the greenback continues to dominate, reflecting strong global demand for the dollar amid economic uncertainty and high interest rates abroad.

Every centavo move matters—fuel, food, and imported goods feel it first.

PHP vs Japanese Yen

The Japanese yen trades at ₱0.375 per yen.

Despite Japan’s long-standing economic strength, the yen remains weak, making travel and imports from Japan relatively cheaper for Filipinos.

PHP vs British Pound

The British pound stands tall at ₱80.04.

It remains one of the strongest currencies globally, highlighting how far the peso stretches just to keep up with Europe’s major economies.

PHP vs Hong Kong Dollar

The Hong Kong dollar is pegged closely to the US dollar and trades at ₱7.48.

For OFWs in Hong Kong, stability matters—and this peg keeps the HKD predictable against the peso.

PHP vs Swiss Franc

Often seen as a safe haven, the Swiss franc now costs ₱76.31.

In times of global tension, investors flock to it—leaving weaker currencies like the peso trailing behind.

PHP vs Canadian Dollar

The Canadian dollar trades at ₱43.12.

Commodity prices and global demand play a big role here, keeping the loonie relatively steady against the peso.

PHP vs Singapore Dollar

The Singapore dollar, a regional powerhouse, stands at ₱46.20.

Its strength reflects Singapore’s disciplined monetary policy—something many Asian economies aspire to match.

PHP vs Australian Dollar

At ₱41.44, the Australian dollar remains competitive, driven by mining exports and strong trade links across Asia.

PHP vs Bahrain Dinar

The Bahrain dinar towers over most currencies at ₱155.07.

It’s one of the strongest currencies in the world—making remittances from the Middle East especially valuable for Filipino families back home.

PHP vs Saudi Riyal

The Saudi riyal trades at ₱15.58, closely tied to the US dollar.

With thousands of Filipinos working in Saudi Arabia, even small movements here ripple across household budgets.

PHP vs Brunei Dollar

The Brunei dollar, aligned with the Singapore dollar, stands at ₱46.02, showing similar regional strength.

PHP vs Indonesian Rupiah

At ₱0.0035, the Indonesian rupiah highlights how both countries face similar pressures as emerging economies navigating global headwinds.

PHP vs Thai Baht

The Thai baht trades at ₱1.88, reflecting Thailand’s reliance on tourism and regional trade recovery.

PHP vs UAE Dirham

The UAE dirham is priced at ₱15.91, another crucial rate for OFWs in the Middle East sending money home.

What This Means for Filipinos

Today’s numbers paint a clear picture.

The peso remains under strain—caught between global interest rate pressures, import dependence, and shifting investor sentiment. While some regional currencies share the same struggles, major global currencies continue to pull ahead.

For now, the peso holds its ground.

But every tick on the exchange board reminds Filipinos why currency movements matter—at the grocery, at the pump, and in every remittance sent home.

And tomorrow, the numbers will tell a new story.