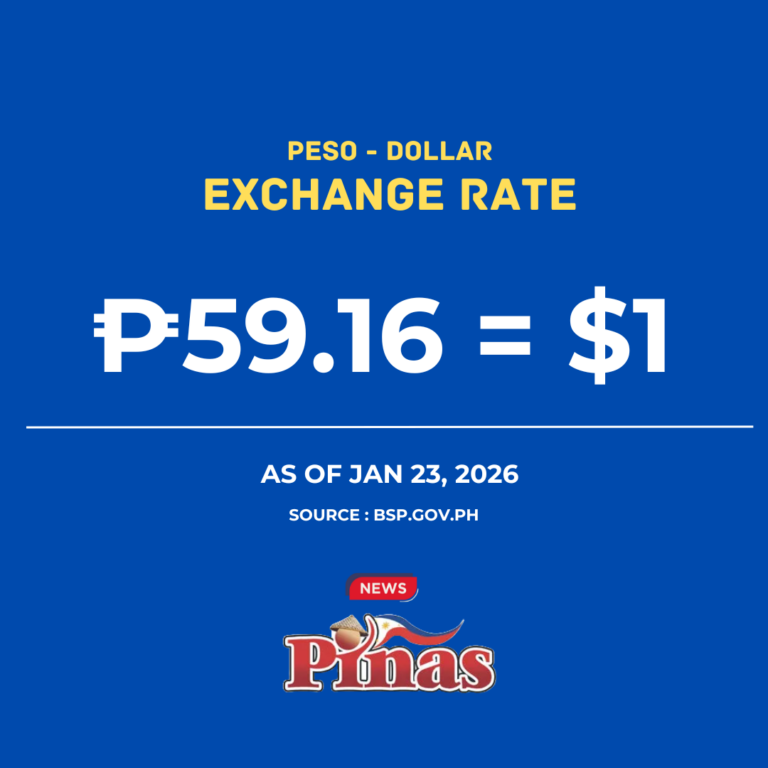

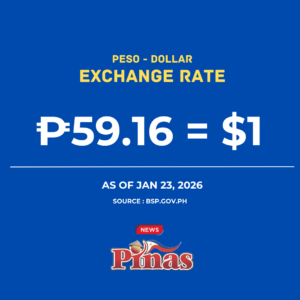

The Philippine peso is facing another tough week. According to the Bangko Sentral ng Pilipinas exchange rate bulletin as of November 6, 2025, the US dollar continues to strengthen — leaving overseas Filipinos anxious and importers worried.

The BSP sets today’s reference rate at ₱58.85 per $1, slightly weaker than yesterday. Every centavo drop affects the cost of food, fuel, and overseas loans. But for OFWs, a stronger dollar also means a little more peso for every remittance sent home.

Here’s what’s happening with the top 15 most-watched currencies — and why it matters:

💱 TOP 15 CURRENCIES VS PHILIPPINE PESO

(What it means for your wallet)

1️⃣ US Dollar (₱58.75)

Still king. Dollar strength continues — great for OFWs, tough on prices of imported goods.

2️⃣ Japanese Yen (₱0.38)

Still weak. Good news for Pinoys traveling to Japan and for tech companies importing equipment.

3️⃣ British Pound (₱76.68)

Stronger than ever — costly for UK-based students and workers paying rent or tuition.

4️⃣ Hong Kong Dollar (₱7.56)

Remittances from HK lift more pesos, helping families back home.

5️⃣ Swiss Franc (₱72.51)

A haven currency — high value reflects global economic uncertainty.

6️⃣ Canadian Dollar (₱41.65)

Slight climb — a good week for OFWs in Canada.

7️⃣ Singapore Dollar (₱44.96)

Still strong — Singapore-based Pinoys send home more pesos.

8️⃣ Australian Dollar (₱38.20)

Steady climb — better returns for migrants working Down Under.

9️⃣ Bahraini Dinar (₱155.85)

One of the world’s strongest currencies — huge boost for OFWs in the Middle East.

🔟 Kuwaiti Dinar (N/A)

Rates temporarily unavailable — often ranks #1 strongest worldwide.

11️⃣ Saudi Riyal (₱15.66)

Reliable strength — benefiting millions of OFWs in Saudi.

12️⃣ Brunei Dollar (₱44.79)

Moves closely with Singapore — strong remittance value.

13️⃣ Indonesian Rupiah (₱0.0035)

Very low unit value — but still important for ASEAN trade.

14️⃣ Thai Baht (₱1.81)

Stronger Baht means costlier travel to Thailand for tourists.

15️⃣ UAE Dirham (₱15.99)

High and steady — OFWs in Dubai are sending more peso power home.

🇵🇭 So… good or bad for Filipinos?

✅ Good for OFWs — Their families get more pesos per remittance

❌ Bad for consumers — Expect costlier rice, fuel, medicine, gadgets

⚠️ Uncertain months ahead — Global rates are volatile heading into the holidays

Every movement in foreign exchange is personal — it affects grocery budgets, school fees, and lives of millions of Filipinos here and abroad.

The world economy is shifting fast. And the peso is holding on.