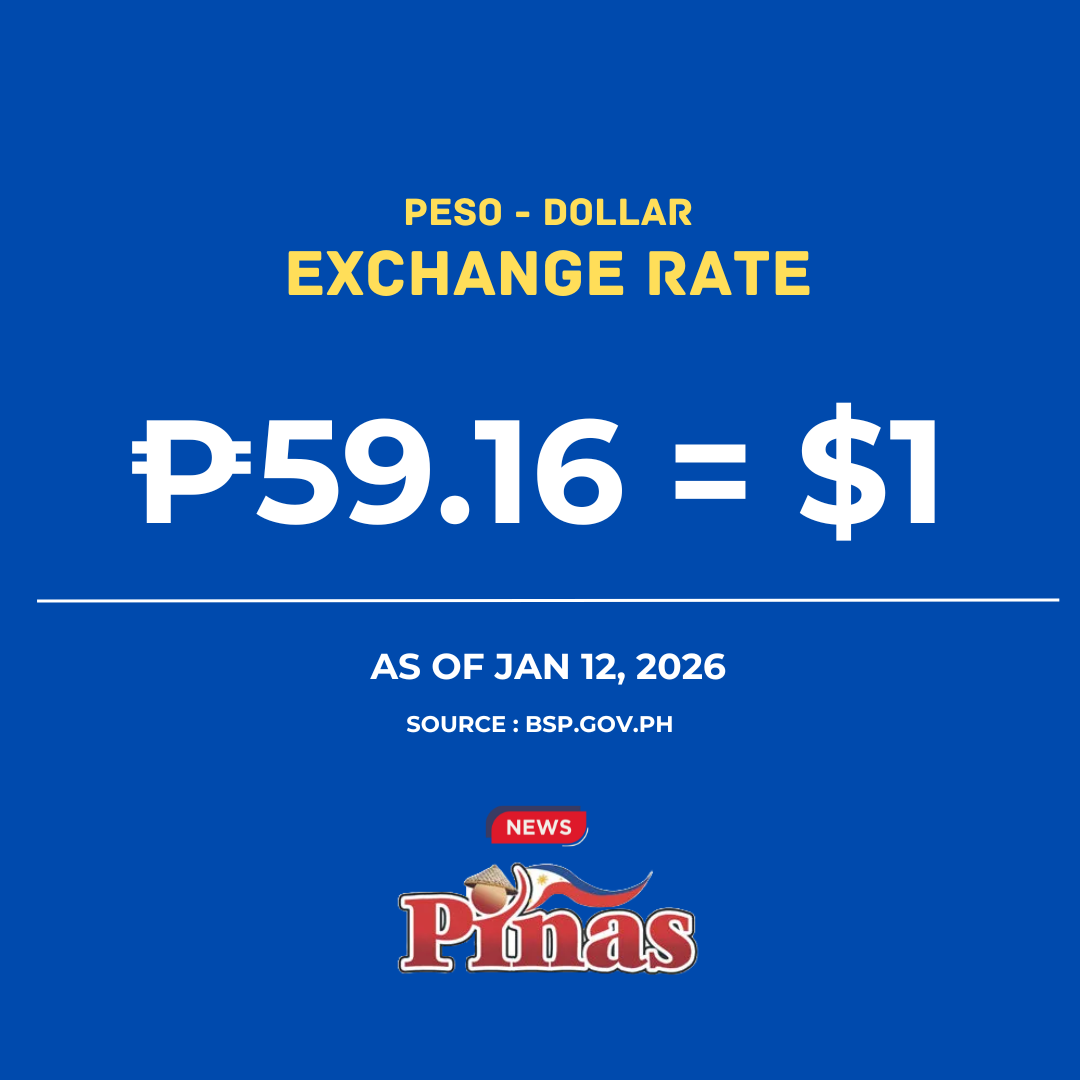

As of January 12, 2026, the Philippine peso (PHP) continues to navigate a challenging global currency landscape, according to the latest Bangko Sentral ng Pilipinas (BSP) Reference Exchange Rate Bulletin.

At the center of it all is the US dollar, still the peso’s strongest benchmark.

Today, $1 = PHP 59.164, a level that reflects continued global demand for the dollar amid economic uncertainty and tight financial conditions worldwide. The BSP reference rate stands at PHP 59.250, with buying and selling rates ranging between PHP 59.00 and PHP 59.50.

Here’s how the peso compares against the world’s top currencies today and what it means.

Peso vs US Dollar and Major Global Currencies

The US dollar remains firm against the peso, keeping import costs high and pressuring local prices. Meanwhile, other major currencies also trade at elevated peso levels.

The British pound is among the strongest, with 1 GBP now equivalent to PHP 79.27, reflecting the pound’s resilience despite global market swings.

The Swiss franc, often seen as a safe-haven currency, stands at PHP 73.90, while the euro trades at PHP 68.88, highlighting the peso’s weaker position against Europe’s major economies.

Asia-Pacific Currencies: Mixed Performance

In Asia, the picture is mixed.

The Japanese yen remains relatively weak, with 1 JPY worth just PHP 0.374, offering some relief for Philippine importers dealing with Japan.

The Singapore dollar, however, stays strong at PHP 45.97, followed closely by the Brunei dollar at PHP 45.80, reflecting the region’s economic stability.

The Hong Kong dollar trades at PHP 7.59, while the Chinese yuan stands at PHP 8.48, showing steady regional trade dynamics.

Middle East Currencies Hold Strong

Currencies from the Middle East continue to outperform.

The Saudi riyal trades at PHP 15.78, while the UAE dirham stands at PHP 16.11, significant figures given the Philippines’ deep labor and trade ties with the region.

The Bahrain dinar remains one of the world’s strongest currencies at PHP 156.99 per dinar, underscoring its high valuation.

Commodity and Emerging Market Currencies

The Australian dollar and Canadian dollar trade at PHP 39.53 and PHP 42.52, respectively, reflecting movements in global commodity markets.

Meanwhile, emerging market currencies remain much weaker against the peso. The Indonesian rupiah is valued at just PHP 0.0035, while the Thai baht trades at PHP 1.89.

What This Means for Filipinos

For importers and travelers, a weaker peso means higher costs for goods, fuel, and overseas expenses. For exporters and OFW families, however, the stronger foreign currencies translate to higher peso value for remittances sent home.

As global markets remain volatile, today’s exchange rates highlight a familiar reality: the peso continues to feel pressure, but it also benefits from strong inflows tied to overseas work and trade.

For now, all eyes remain on the dollar—and on how global economic shifts will shape the peso’s next move.