The Bangko Sentral ng Pilipinas (BSP) released its latest Reference Exchange Rate Bulletin on October 21, 2025, giving Filipinos and global investors a snapshot of how the world’s major currencies are performing against the Philippine peso.

The peso is currently trading at an average of ₱58.14 per US dollar, reflecting the continued strength of the greenback as global markets adjust to high interest rates and geopolitical uncertainty.

Here’s what’s happening across the top 15 most watched currencies today — and what it means for the Philippine market.

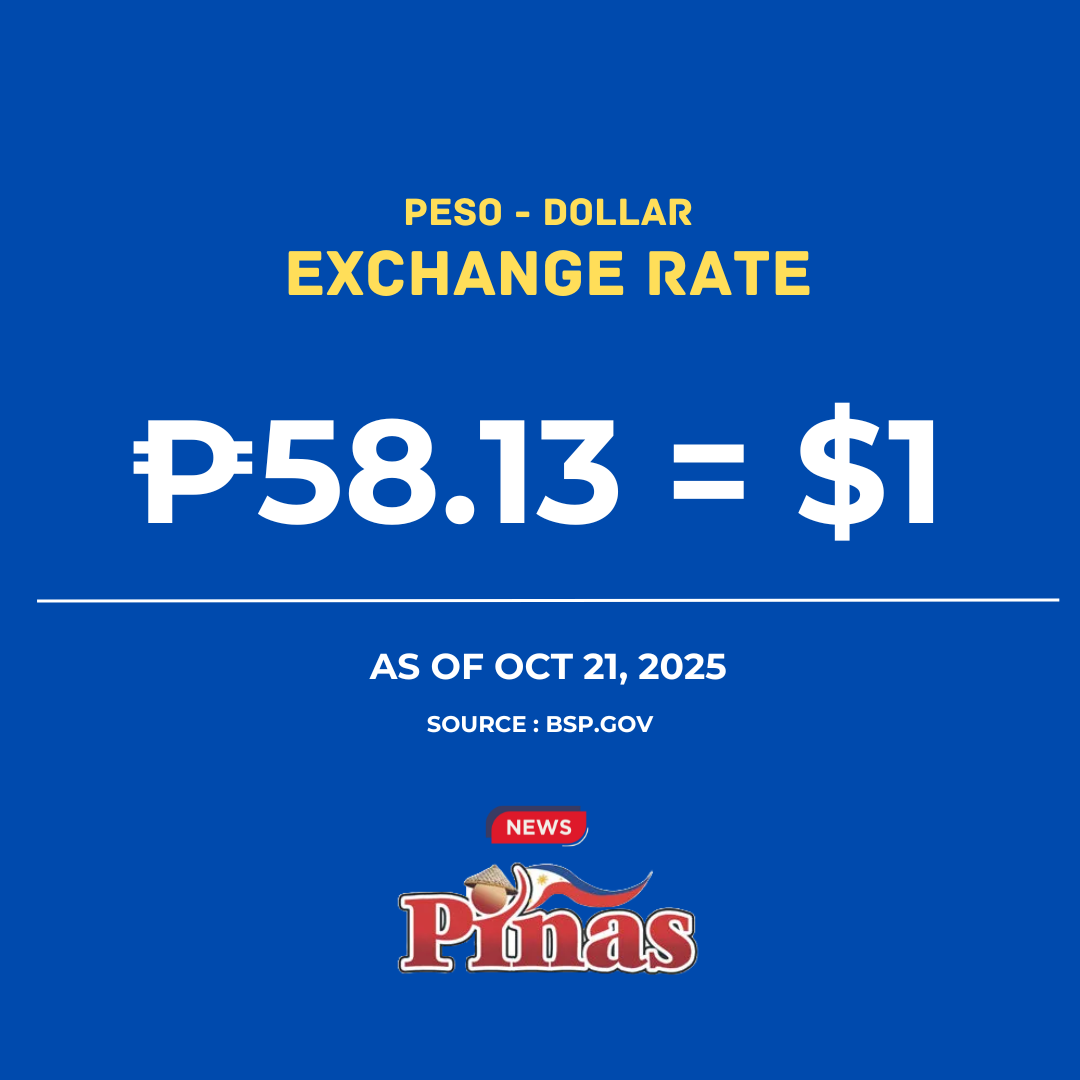

1. United States Dollar (USD) – ₱58.13

The US dollar remains dominant, holding firm as investors flock to it amid global volatility. The dollar’s strength continues to pressure emerging market currencies, including the peso, though BSP intervention has helped stabilize fluctuations.

2. Japanese Yen (JPY) – ₱0.3860

The yen stays weak, still reeling from Japan’s ultra-loose monetary policy. While the Bank of Japan has hinted at tightening measures, the currency remains near multi-decade lows, favoring exporters but hurting importers.

3. British Pound (GBP) – ₱77.97

The pound gained modestly, reflecting market optimism over improving UK economic data. However, inflation remains sticky, making the Bank of England’s next moves highly anticipated.

4. Hong Kong Dollar (HKD) – ₱7.48

The Hong Kong dollar remains pegged to the US dollar, showing little movement. Its stability continues to make it a safe regional currency for trade and investment.

5. Swiss Franc (CHF) – ₱73.38

Known as a safe-haven currency, the Swiss franc remains strong as global investors seek shelter from market risks. Its steady climb mirrors cautious investor sentiment worldwide.

6. Canadian Dollar (CAD) – ₱41.42

The Canadian dollar softened slightly due to lower oil prices. With Canada’s economy closely tied to energy exports, the loonie often moves in step with global crude trends.

7. Singapore Dollar (SGD) – ₱44.95

The Singapore dollar remains one of Asia’s most stable currencies. Backed by strong fiscal discipline and trade resilience, it continues to perform well against regional peers, including the peso.

8. Australian Dollar (AUD) – ₱37.87

The Aussie dollar dipped amid declining commodity prices and weaker demand from China. However, it remains resilient, supported by Australia’s steady economic fundamentals.

9. Bahraini Dinar (BHD) – ₱154.23

The Bahraini dinar is among the world’s strongest currencies. Its high value reflects Bahrain’s oil-backed economy and tight monetary policy anchored to the US dollar.

10. Kuwait Dinar (KWD) – Data Not Available

Data for the Kuwaiti dinar — traditionally the highest-valued currency in the world — was not available in this bulletin. Historically, 1 KWD trades above ₱190.

11. Saudi Riyal (SAR) – ₱15.50

The Saudi riyal, pegged to the US dollar, remains stable. Its strength continues to benefit overseas Filipino workers (OFWs) in the Middle East, whose remittances rise in peso value.

12. Brunei Dollar (BND) – ₱44.77

Mirroring Singapore’s economy, the Brunei dollar remains firm. Its peg to the Singapore dollar gives it the same regional strength and stability.

13. Indonesian Rupiah (IDR) – ₱0.0035

The Indonesian rupiah remains weak, reflecting inflationary pressures and capital outflows. Still, Indonesia’s strong domestic demand has cushioned some of the impact.

14. Thai Baht (THB) – ₱1.79

The Thai baht is recovering slightly after earlier weakness tied to slower tourism and exports. Investors are watching Thailand’s fiscal policy as it aims to revive post-pandemic growth.

15. UAE Dirham (AED) – ₱15.83

The UAE dirham stays strong, thanks to its peg to the US dollar and the Emirates’ growing role as a global trade and tourism hub. It remains a key remittance currency for OFWs.

What This Means for Filipinos

The peso’s steady performance at ₱58.14 reflects a delicate balance — strong dollar demand from importers versus sustained OFW remittances and rising tourism receipts.

The BSP continues to closely monitor foreign exchange movements, keeping the buying rate at ₱57.90 and selling rate at ₱58.40 to manage volatility.

For overseas Filipinos, this means stronger remittance value, but for local consumers, imported goods and travel abroad remain more expensive.

As the global economy faces inflation, war tensions, and shifting trade alliances, the peso’s stability — even in the face of a dominant dollar — is a quiet but important win for the Philippines.