How the Peso Stacks Up Against the Top 15 Global Currencies

The Philippine peso opened the week under pressure—steady, but clearly tested.

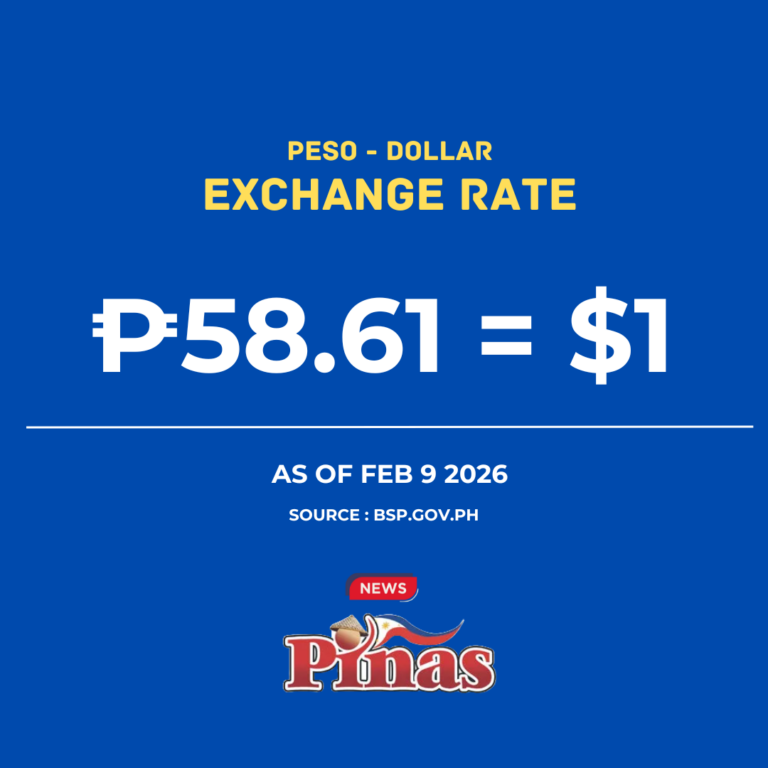

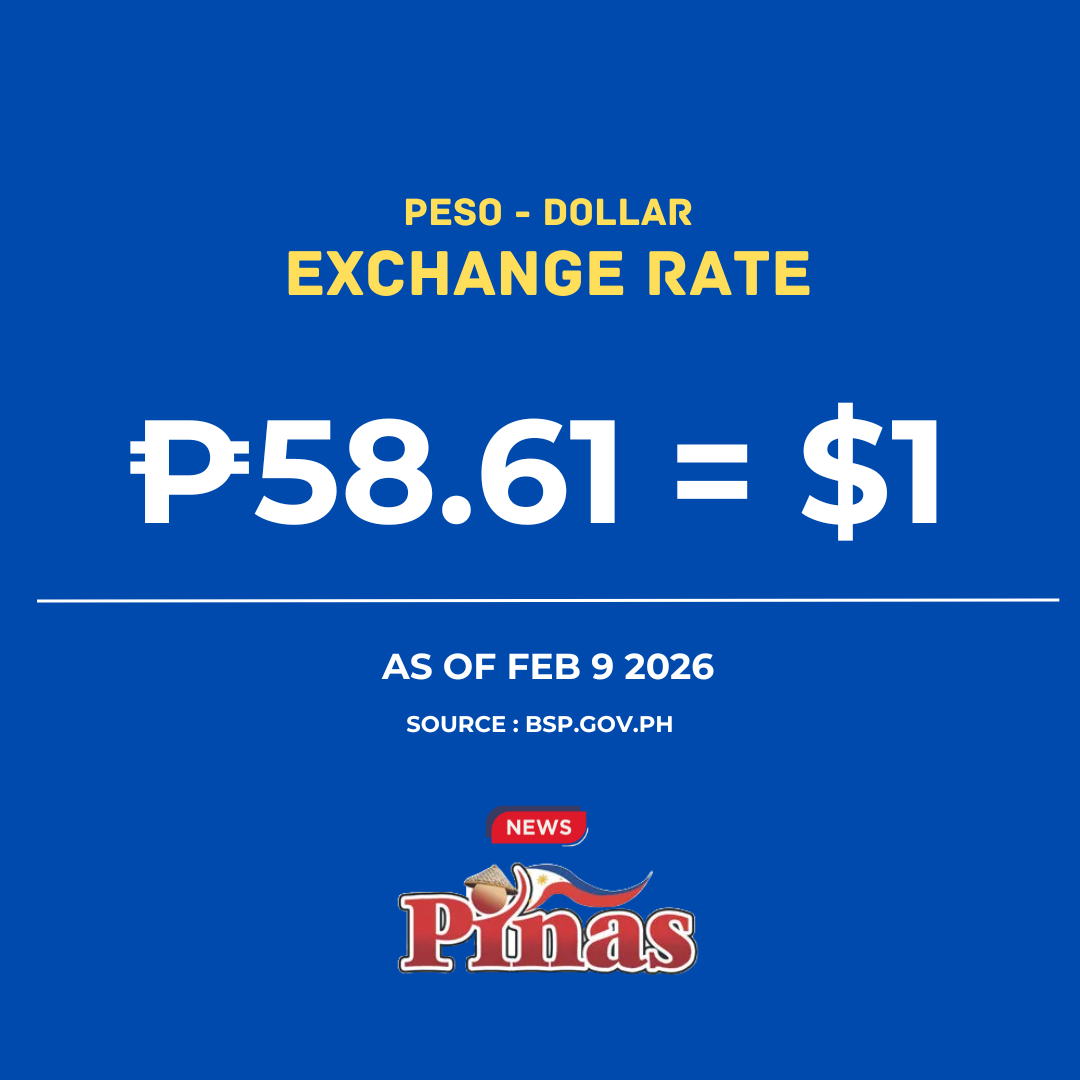

Based on the Bangko Sentral ng Pilipinas (BSP) Reference Exchange Rate Bulletin for February 9, 2026, the peso continues to feel the weight of a strong U.S. dollar and firm Middle East currencies, while holding its ground against several Asian peers.

Here’s what’s happening—currency by currency—through the lens that matters most: PHP vs the world.

🇺🇸 US Dollar (USD): PHP 58.619

The dollar remains king.

At ₱58.62, the greenback continues to dominate global markets. High U.S. interest rates and safe-haven demand are keeping the dollar strong—making imports more expensive and putting pressure on the peso.

This remains the key benchmark for all other currencies.

🇬🇧 British Pound (GBP): PHP 79.72

The pound stays expensive.

One pound now costs nearly ₱80, reflecting the UK currency’s strength against both the dollar and the peso. For Filipinos with UK expenses or remittances, this gap is impossible to ignore.

🇨🇭 Swiss Franc (CHF): PHP 75.57

Still a global safe haven.

The franc’s strength shows investors are playing it safe. At ₱75.57, it remains one of the most expensive currencies against the peso.

🇧🇭 Bahrain Dinar (BHD): PHP 155.49

The strongest of them all.

At over ₱155 per dinar, Bahrain’s currency highlights just how powerful Gulf currencies remain—largely due to their fixed pegs and oil-backed economies.

🇪🇺 Euro (EUR): PHP 69.36

Europe holds firm.

The euro is trading above ₱69, reflecting resilience despite economic headwinds. For Filipino travelers and businesses tied to Europe, costs remain elevated.

🇨🇦 Canadian Dollar (CAD): PHP 42.87

More affordable—but still strong.

The loonie sits in the mid-₱40 range, offering some relief compared to the pound or euro, but still well above pre-pandemic peso levels.

🇸🇬 Singapore Dollar (SGD): PHP 46.13

Regional strength shows.

Singapore’s currency remains one of Asia’s strongest, trading above ₱46—a sign of investor confidence in the city-state’s economy.

🇦🇺 Australian Dollar (AUD): PHP 41.07

Commodity-linked and steady.

The Aussie dollar stays just above ₱41, supported by global demand for resources, but softer than other Western currencies.

🇯🇵 Japanese Yen (JPY): PHP 0.37

Still weak—but stabilizing.

At just ₱0.37 per yen, Japan’s currency remains historically low. This benefits Filipino importers—but highlights Japan’s long struggle with inflation and growth.

🇭🇰 Hong Kong Dollar (HKD): PHP 7.50

Firm and predictable.

The HK dollar stays stable at ₱7.50, anchored by its peg to the U.S. dollar.

🇸🇦 Saudi Riyal (SAR): PHP 15.63

Strong and steady.

Like other Gulf currencies, the riyal benefits from oil revenues and dollar linkage—keeping it firm against the peso.

🇦🇪 UAE Dirham (AED): PHP 15.96

Another Gulf heavyweight.

Close to ₱16, the dirham continues to reflect strength in Middle Eastern economies where many Filipinos work.

🇹🇭 Thai Baht (THB): PHP 1.86

Regional balance.

The baht trades at ₱1.86, moving closely with other ASEAN currencies amid tourism recovery and regional trade.

🇮🇩 Indonesian Rupiah (IDR): PHP 0.0035

Low value, similar pressures.

The rupiah remains weak in nominal terms, reflecting shared challenges among emerging Asian markets.

🇧🇳 Brunei Dollar (BND): PHP 45.95

Quietly strong.

Closely aligned with the Singapore dollar, the Brunei dollar stays firm just under ₱46.

💱 Peso Snapshot

-

BSP Reference Rate: ₱58.600

-

Buying Rate: ₱58.350

-

Selling Rate: ₱58.850

-

PDS Closing (Feb 6, 2026): ₱58.585

Gold and silver prices also remain elevated—another sign that global markets are still cautious.

The Big Picture

The story today is not collapse—but pressure.

The peso is holding its line, but strong global currencies—especially the U.S. dollar and Gulf dinars—continue to stretch its limits. For OFWs, importers, and travelers, every decimal point matters.

And today, the world’s currencies are reminding the peso just how tough the global stage remains.