The Philippine peso woke up to another demanding day in the global market.

Based on the Bangko Sentral ng Pilipinas (BSP) Reference Exchange Rate Bulletin, the peso continues to feel pressure against major world currencies — especially the US dollar — while holding mixed ground against others.

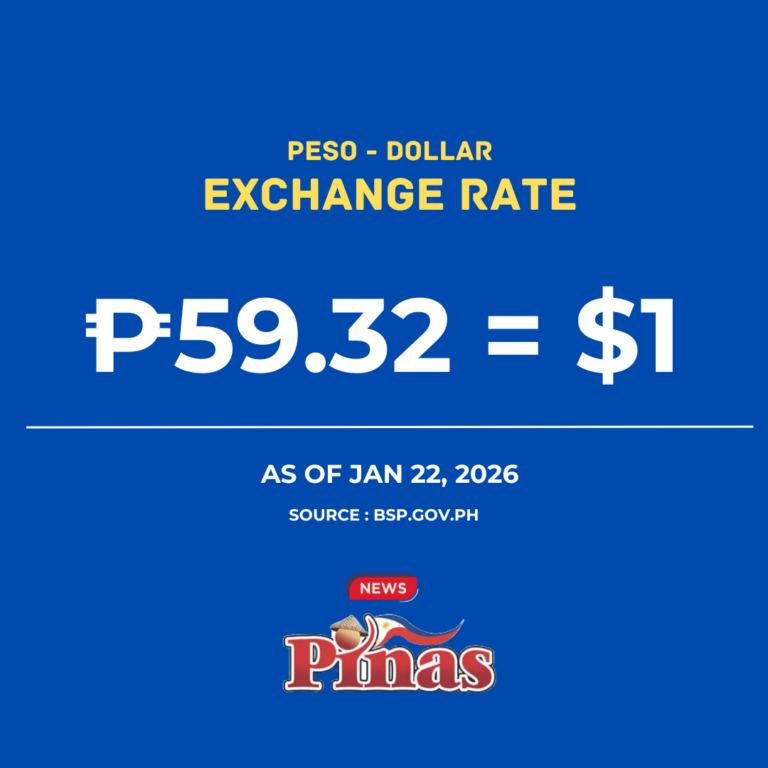

Here’s what’s happening today, January 22, 2026, broken down simply and clearly.

The Big Picture: Peso vs US Dollar

At the center of everything is the US dollar, now at:

₱59.32 = $1

This keeps the peso near the ₱59 range, a level that reflects ongoing global uncertainty, strong US economic momentum, and cautious emerging-market sentiment.

BSP rates today show:

-

Buying: ₱59.00

-

Selling: ₱59.50

-

Reference: ₱59.25

The message is clear — the peso is stable, but still under pressure.

How the Peso Stacks Up Against the Top 15 Currencies

🇺🇸 United States Dollar (USD)

₱59.32

The benchmark. The peso remains weak as investors continue favoring the dollar as a safe haven.

🇯🇵 Japanese Yen (JPY)

₱0.37 per ¥1

The yen stays soft globally, making Japan one of the more affordable major economies for peso holders.

🇬🇧 British Pound (GBP)

₱79.69

Still one of the strongest currencies. The pound towers over the peso, driven by tight monetary policy and resilient UK markets.

🇭🇰 Hong Kong Dollar (HKD)

₱7.61

Closely tied to the US dollar, the HKD mirrors dollar strength against the peso.

🇨🇭 Swiss Franc (CHF)

₱74.58

A classic safe-haven currency. The franc remains expensive as investors seek stability.

🇨🇦 Canadian Dollar (CAD)

₱42.88

Moderate strength here. The peso holds better ground against the loonie compared to European currencies.

🇸🇬 Singapore Dollar (SGD)

₱46.20

Still strong. Singapore’s disciplined monetary framework keeps its currency firm versus the peso.

🇦🇺 Australian Dollar (AUD)

₱40.10

The peso performs slightly better here, as commodity price swings affect the Aussie dollar.

🇧🇭 Bahrain Dinar (BHD)

₱157.39

One of the strongest currencies globally. The peso is heavily outmatched due to the dinar’s tight peg and high valuation.

🇸🇦 Saudi Riyal (SAR)

₱15.82

Stable and predictable. The riyal’s peg to the US dollar keeps movements steady.

🇧🇳 Brunei Dollar (BND)

₱46.02

Nearly identical to the Singapore dollar, reflecting Brunei’s currency arrangement with Singapore.

🇮🇩 Indonesian Rupiah (IDR)

₱0.0035

The peso remains far stronger here, highlighting shared emerging-market challenges — but with the peso holding an edge.

🇹🇭 Thai Baht (THB)

₱1.90

A close regional comparison. The peso and baht remain relatively competitive with each other.

🇦🇪 UAE Dirham (AED)

₱16.15

Another dollar-pegged currency, moving in line with US dollar strength.

🇪🇺 Euro (EUR)

₱69.32

Europe’s common currency remains strong against the peso, supported by tighter financial conditions in the eurozone.

What This Means for Filipinos

-

Imports remain expensive, especially those priced in dollars and euros

-

OFW remittances get more peso value

-

Travel to Japan and Southeast Asia stays relatively affordable

-

Dollar-denominated debt remains costly

Gold and silver prices also reflect global caution, with gold buying at $4,784.25 and silver at $91.15.

Bottom Line

The peso is holding its ground — but it’s fighting strong global currents.

Against the dollar and major European currencies, the struggle continues.

Against regional neighbors, the peso shows resilience.

As markets move forward, all eyes remain on inflation, interest rates, and global stability — factors that will decide where the peso goes next.

Today’s takeaway:

The peso survives — but the pressure isn’t easing just yet.