The Philippine peso opened the day under pressure.

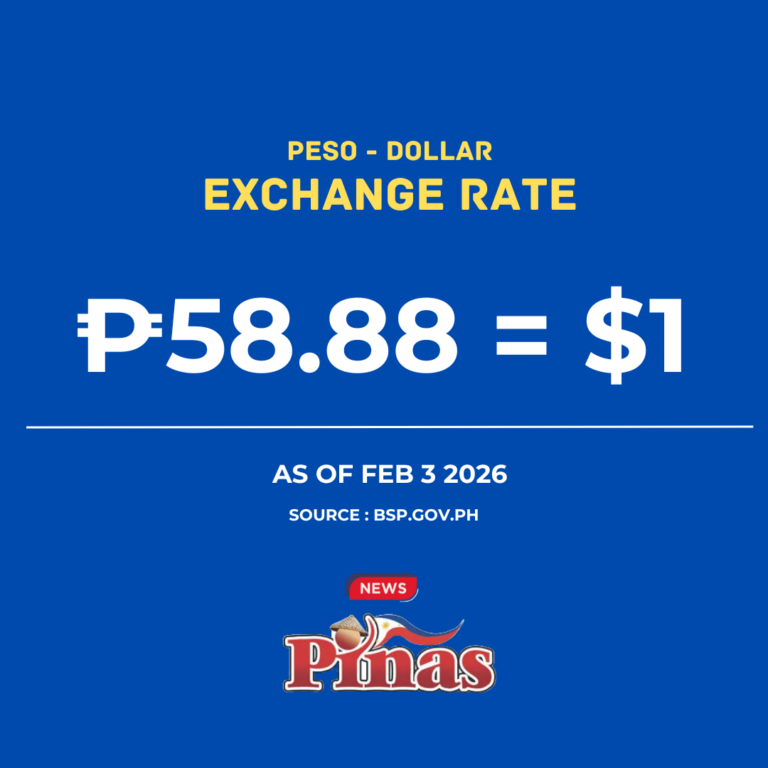

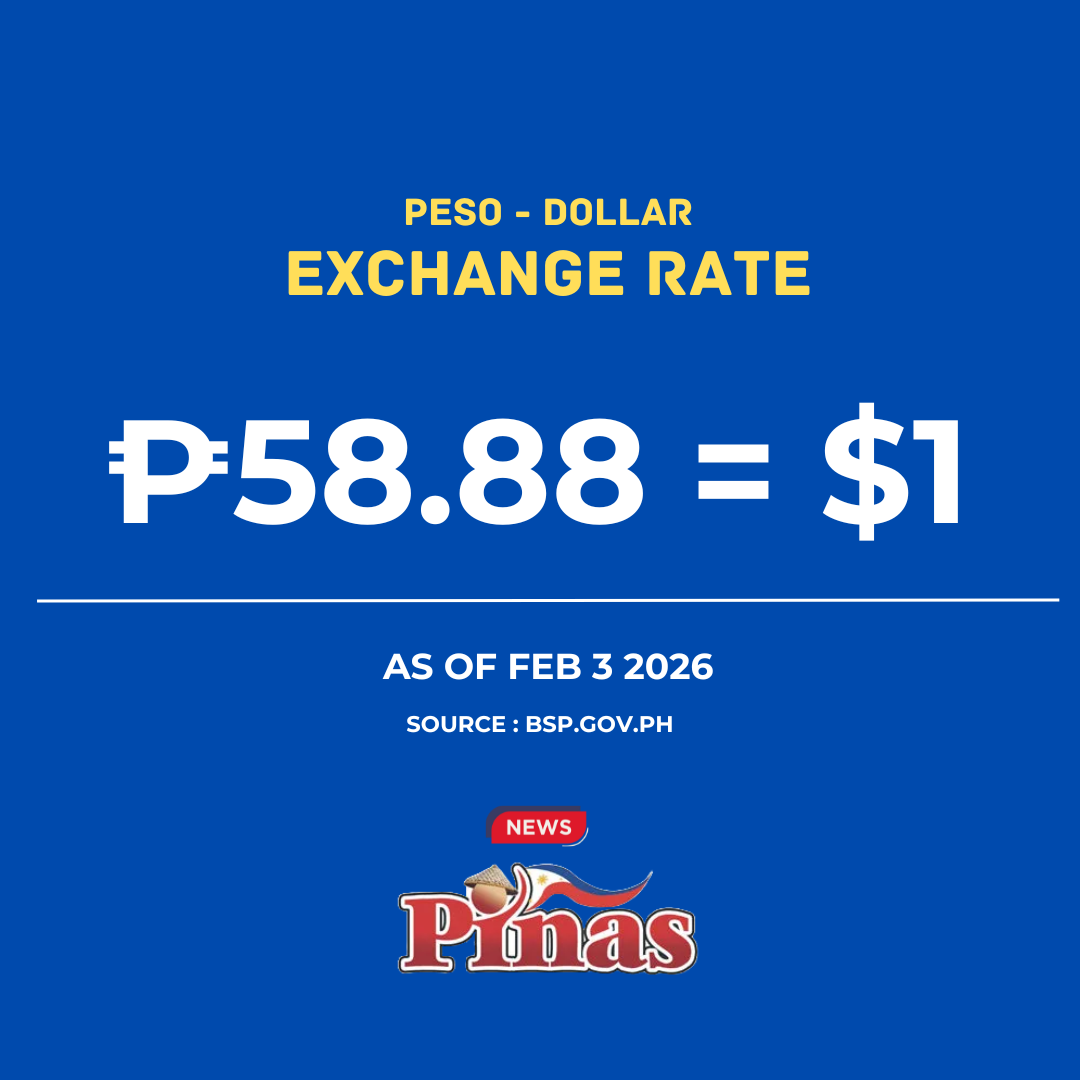

As of February 3, 2026, the Bangko Sentral ng Pilipinas (BSP) set the reference rate at ₱58.90 per US dollar, a level that continues to test the peso’s resilience against major global currencies.

For ordinary Filipinos, this means one thing:

foreign currencies remain expensive — and the dollar still leads the pack.

Let’s break down what’s happening.

Peso vs US Dollar: Still the Main Battle

The US dollar (USD) stands at ₱58.887, keeping the peso near the 59-peso mark.

This reflects continued global demand for the dollar — driven by strong US economic data and cautious global markets. When investors seek safety, they run to the dollar… and emerging-market currencies like the peso feel the weight.

How the Peso Stacks Up Against the Top 15 Currencies

Here’s how ₱1 compares against the world’s most followed currencies today — and what it means.

Strongest Against the Peso (Most Expensive)

• Bahrain Dinar (BHD) – ₱156.25

👉 One of the strongest currencies globally. Oil-backed and tightly managed.

• British Pound (GBP) – ₱80.49

👉 Still firm despite global uncertainty.

• Swiss Franc (CHF) – ₱75.54

👉 A classic safe-haven currency.

• Euro (EUR) – ₱69.45

👉 Holding steady as Europe stabilizes inflation.

Mid-Tier Heavyweights

• Singapore Dollar (SGD) – ₱46.30

• Canadian Dollar (CAD) – ₱43.05

• Australian Dollar (AUD) – ₱40.91

• New Zealand Dollar (NZD) – ₱35.32

👉 These currencies reflect stable economies with strong trade links — making them pricier than the peso but less volatile than the dollar.

Regional Neighbors & Trade Partners

• Hong Kong Dollar (HKD) – ₱7.54

• Chinese Yuan (CNY) – ₱8.48

• Thai Baht (THB) – ₱1.87

• Indonesian Rupiah (IDR) – ₱0.0035

👉 The peso remains competitive within Southeast Asia, though China’s yuan continues to hold firm due to tight controls.

Middle East & Gulf Currencies

• Saudi Riyal (SAR) – ₱15.70

• UAE Dirham (AED) – ₱16.03

👉 Pegged to the US dollar, these currencies move closely with USD strength.

What This Means for Filipinos

• Imports stay expensive

• Overseas travel costs more

• Dollar earners benefit

• Exporters gain some relief

For now, the peso is holding its ground — but not gaining strength.

Key BSP Rates to Watch

• BSP Reference Rate: ₱58.90

• Buying Rate: ₱58.65

• Selling Rate: ₱59.15

• PDS Closing (Feb 2): ₱58.899

Precious metals also climbed, with gold at $4,779 and silver at $82.90, signaling continued investor caution.

The Bottom Line

The peso isn’t collapsing — but it’s not catching a break either.

Against the world’s top currencies, the message today is clear:

the dollar remains king, and the peso is still fighting uphill.